In 2022, Chef’s Pencil reported that the veganism movement had lost momentum, marking the beginning of a steep and steady decline in public interest.

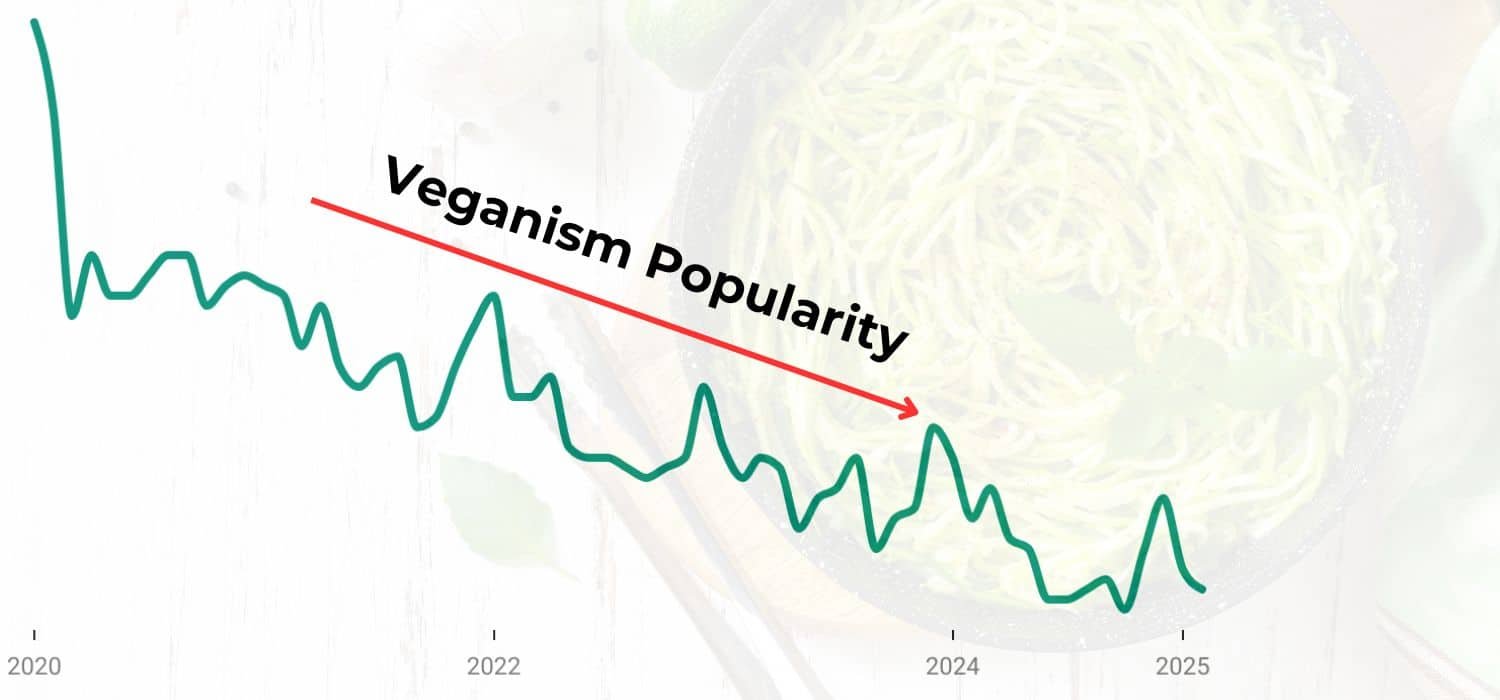

Recent Google Trends data confirms this shift. Popularity of the topic Veganism—which includes search queries related to vegan diets, recipes, restaurants, and clothing—has dropped to levels last seen in 2015 and 2016. This is in sharp contrast to its peak in 2020.

While the popularity of veganism has fluctuated worldwide, the downward trend that began in 2020 and 2021 in many countries has remained consistent.

Some argue that the decline in Google search volume reflects veganism becoming more mainstream, leading to fewer searches for products like “vegan chocolate” or “vegan cheese” as they become more widely available. However, this explanation does not fully account for the overall decline in interest.

For instance, searches for “vegan recipes” and “vegan recipes for beginners” have declined significantly in multiple countries, including Australia, the United Kingdom, and the United States. At the same time, general recipe searches have increased, suggesting that the decline is not due to people cooking less at home but rather a broader shift away from vegan diets.

Social Media Tools Show Declining Engagement for Vegan-Related Topics

To further analyze the decline, we examined social media engagement using Social Blade, a platform that tracks follower growth and engagement metrics.

According to Social Blade, Veganuary’s Instagram account saw a dramatic slowdown in growth—from 49,600 new followers in January 2020 to 9,300 in January 2024, and just 5,500 in January 2025.

Despite this, Veganuary’s 2025 campaign numbers showed an increase in participants compared to the previous year, and media coverage also grew substantially. However, a Veganuary spokesperson clarified that the rise in participants was primarily due to expansion into additional countries rather than increased enthusiasm in existing markets.

We are definitely in an adjustment phase. Health-conscious consumers are also seeking less processed meat alternatives, so we are seeing natural protein sources such as tofu, tempeh, chickpeas, and lentils grow in popularity.

Toni Vernelli, International Head of Communications, Veganuary

Additionally, the spokesperson attributed declining Google searches to greater public familiarity with Veganuary and veganism, as well as the wider availability of vegan products in stores, reducing the need for online searches. However, they also acknowledged that veganism has likely reached peak popularity and entered an adjustment phase, with more consumers shifting toward less processed plant-based options.

Vegan Restaurants Face Significant Struggles

Vegan restaurants don’t seem to be faring much better. There have been numerous reports of struggling vegan establishments from Britain to the United States, with many either adapting their menus to include vegetarian or even meat-based dishes (to the dismay of their vegan clientele) or shutting down entirely.

The restaurant industry is notoriously tough, and closures are anything but uncommon. However, vegan restaurants appear to be among the hardest hit. According to Eric Brent, founder of HappyCow, the largest global marketplace for vegan and vegetarian restaurants and stores, many vegan establishments are struggling with high rent, rising food costs, and a sharp decline in guests. In an October 2024 interview with VegNews, Brent put it bluntly: “2023 was a devastating year for vegan restaurants.”

Strict veganism has seen a major pushback.

Eric Brent, founder of HappyCow

Strict veganism has seen a major pushback, and this trend appears to have continued into 2024 as vegan restaurants struggle to stay afloat. In an industry where margins are already thin, plant-based establishments face unique challenges. Responding to a request from Chef’s Pencil, Brent noted that while plant-based eating continues to grow, strict veganism—particularly in the restaurant sector—has lost momentum:

“From my perspective, plant-based eating continues to grow, but strict veganism has seen a major pushback. While this is mostly in the vegan restaurant sector, veganism in general has lost momentum due to factors like:

No in-person vegan events taking place during Covid-19.

Less focus on influencers since most people were focused on news.

An organized effort by big meat & dairy to promote veganism as unhealthy through mainstream advertisement.”

Additionally, Brent highlighted increased competition from mainstream restaurants offering plant-based options and the financial challenges of operating a business with traditionally lower profit margins:

“Vegan restaurants have low margins, generally speaking, don’t have alcohol, and need every customer to survive.”

While many challenges—such as high rents, inflation, and the impact of remote work on lunch earnings—affect the restaurant industry as a whole, vegan restaurants face an uphill battle due to the nature of their business model. Without significant adaptation, many of these establishments may continue to struggle in the coming years.

Google Search Changes and Methodology Shift Spark Confusion

Over the past couple of years, some reports have suggested that interest in vegan food and vegan restaurants had skyrocketed to all-time highs, based on Google data showing a sharp increase in searches for vegan restaurants near me or vegan food near me.

However, this spike was likely the result of a change in Google’s reporting methodology or a change in browsing behavior (or both), as similar surges were observed across all “restaurants near me” searches. Despite the apparent increase in search interest, there was no corresponding rise in actual sales, and restaurant revenues in the U.S. certainly did not double.

Number of Vegans in the US: Flat or Declining Trend

Estimating the number of vegans in the U.S. (and worldwide) is challenging due to inconsistent survey results. Multiple polls have reported different and sometimes conflicting figures:

Gallup (2023): Only 1% of Americans identified as vegan, down from 3% in 2018 and 2% in 2012.

Mattson (2020) & McKinsey (2023): Both reported that 2% of Americans followed a vegan diet.

Statista (2023): Found that 4% of Americans identified as vegan, significantly higher than Gallup’s figure.

International Food Information Council (IFIC, 2024): Reported that 2% of Americans followed a vegan diet in both 2022 and 2024, suggesting no growth.

Among these, only Gallup and IFIC have tracked data over multiple years. Gallup suggests a declining trend, whereas IFIC’s data indicates a stagnant vegan population at 2%.

Furthermore, some pro-vegan sources misinterpret survey results. For example, an NGO claimed that 39% of Americans “want to be vegan,” citing a Nielsen survey. However, the actual survey only asked if people wanted to incorporate more plant-based foods—which is not the same as wanting to go fully vegan.

Price Sensitivity and Health Concerns Challenge Vegan Brands

As the enthusiasm surrounding plant-based diets wanes, two of the biggest names in the industry—Beyond Meat and Oatly—are facing mounting challenges. Once celebrated as pioneers of the vegan food revolution, these companies have seen their fortunes shift dramatically in recent years, reflecting broader trends in consumer behavior and the slowing momentum of the vegan movement.

The stock prices for both companies is down by roughly 98% from their peak levels.

Beyond Meat, one of the largest publicly traded companies specializing in plant-based foods, has struggled to maintain its growth amid declining demand in the United States. The company has faced significant headwinds as enthusiasm for plant-based meat appears to have cooled. Beyond Meat’s products, often priced higher than traditional meat, have lost traction in supermarkets as consumers turn to more affordable options. Even some major fast-food chains, which initially embraced plant-based offerings, have scaled back or stopped selling their plant-based menu items entirely, citing lower-than-expected sales.

The company believes that a campaign portraying plant-based burgers as unhealthy has been one of the biggest factors behind declining demand and is actively working to change that perception.

Public perception of vegan food and its health benefits has shifted over the years. Initially praised as a healthier alternative to a meat-based diet, recent reports and growing concerns over the consumption of ultra-processed plant-based foods have led to increased skepticism.

The top result of a Google search for “is vegan food healthy?” includes a report published in 2023 by the National Library of Medicine, which highlights both the benefits and potential adverse health effects of adopting a vegan diet. New research like this, when prominently featured in search engines and the media, can influence public perception of the health benefits of adopting a vegan diet.

Oatly, the Swedish brand known for its oat-based dairy alternatives, has followed a similar downward trajectory. Once hailed as a revolutionary force in the dairy industry, the company now faces a starkly different reality. Since its much-hyped stock market debut in 2021, Oatly’s share price has plummeted by nearly 98%, wiping out billions in market value.

The company’s struggles are not merely financial but symbolic of a larger shift in consumer preferences. While plant-based milk alternatives continue to be a popular choice, the initial surge in excitement has leveled off. Mainstream dairy brands have also entered the plant-based space, offering oat, almond, and soy alternatives at competitive prices, making it harder for Oatly to maintain its once-dominant market position.

Veganism Popularity May Be Declining, but Interest in Plant-Based Foods Remains Strong

While veganism may have lost some of its mainstream appeal, the demand for plant-based foods is not waning. However, there appears to be a disconnect between intention and action. According to a recent report from the EAT Foundation, cited by the Food Institute, 68% of people globally express a desire to eat more plant-based foods, yet only 20% do so regularly—a decline from 23% in 2023.

Flexitarianism seems to be the way forward, as more people adopt plant-forward diets without strictly adhering to vegan or vegetarian lifestyles. This shift is fueling the continued growth of the plant-based foods market, which is expected to double or even triple by 2030.

While veganism itself may be losing traction, its influence on consumer eating habits is undeniable. The movement has led to wider acceptance of plant-based alternatives, and while the strict vegan label may fade, the demand for healthier, less processed plant-based options is likely here to stay.

Notes

Chef’s Pencil is not a licensed investment or financial advisor, and nothing in this report is intended to constitute or be construed as investment advice.